The electricity market is a system that allows purchases through bids to buy; offers to sell; and short-term trades, often in the form of financial or obligation swaps. Offers and bids use the principle of supply and demand to set the pricing. Long-term trades are typically private bi-lateral transactions and are contracts similar to those of power purchase agreements.

Trading in the electricity market differs from trading in traditional financial markets because electricity is generally produced and consumed instantly. Because it cannot be easily stored at the wholesale level, supply and demand have to be balanced in real time.

Electrical energy markets are more fragmented than traditional capital markets. They’re managed and operated by Independent System Operators, or ISOs. These entities work as market operators and perform tasks such as power balancing operations and power plant dispatching. Although rapidly evolving, current electricity storage solutions remain expensive and are not widely available. This results in highly volatile spot electricity prices.

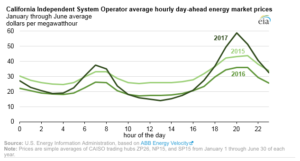

(Image credit: https://www.eia.gov/todayinenergy/detail.php?id=32172)

Spot trading is a contract of buying or selling a commodity for immediate payment and delivery, typically occurring two days following the trade date, known as the spot date. In the electricity market, the spot price is the cost of purchasing electricity from the wholesale market. The price changes every 15, 30 or 60 minutes, depending on the market. The change can be drastic depending on how great a mismatch there is between supply and demand. Prices are typically the highest during the week during the afternoon in the summer and the late afternoon and evening during the winter months. However, in some markets with a lot of solar generation, such as the above chart shows, mid-day the prices can be lower. There is also a five-minute market and the frequency regulation market, which is the highest value market, requires a response every 4 seconds. This requires highly responsive devices such as flywheel and battery storage to participate in this market.

Each trading period, the market uses spot electricity prices to be able to schedule available generation so that the lowest-cost generation is the one that is dispatched first. Spot electricity is divided into four separate categories: forecast, provisional, interim and final. The prices are available to anyone on the WITS, or Wholesale Information and Trading System.

Forecast prices

In the forecast category, WITS forecasts prices using the scheduling, pricing and dispatch model. Some factors this model takes into account are generator offers, the expected state of the electricity system, dispatchable demand offers and purchaser bids. These types of prices provide the consumer with information on how and when to best use electricity.

Provisional prices

After electricity has been generated and used, these prices are then calculated. These prices are sometimes missing the actual meter readings but are the best approximation of what the price is at the time the prices are made available.

Interim prices

This category of prices are published by the pricing manager the day following when the electricity was used. Publishing this type of pricing allows for the consumer to identify if there are any errors or mistakes before the prices are finalized. If the consumer claims an error in pricing, the publication of the final prices will be delayed until the error is addressed.

Final prices

With final prices, the pricing manager calculates them and then sends them to the clearing manager who then calculates the invoice for the settlement between the sellers and buyers. This type of pricing affects the consumer who buys electricity without using the hedge market to manage spot price risk.

The trading of a spot contract is a bilateral agreement between two separate parties that have an obligation to deliver an agreed upon amount of electricity to the other. These contracts can be concluded on an OTC market or an exchange. There are two types of contracts in spot trading: base load and peak load. On a base load contract, the supplier agrees to deliver electricity 24 hours a day, every day, during the delivery period. On a peak load contract, the supplier provides electricity at a continuous power level from 8 a.m. to 8 p.m. Monday through Friday, including public holidays.

Typically, when you purchase electricity, you play a flat rate regardless of when you use it and what the spot price was when the retailer purchased it. Residential users do have the option of choosing a retailer that offers spot pricing, which means the user will be charged a variety of rates. Purchasing electricity at the spot prices comes with some advantages and negatives. When the prices are low, you’re paying substantially less than you would paying a flat rate. However, the flip side is also true and could mean you’re paying a lot more than you would when the demand is high.

Those who may be considering purchasing their electricity at a spot price should ask themselves if they’re able to budget for a varying electricity bill that sometimes will be more expensive than a traditional contract and if they’re willing to use less electricity at the times the bill is higher. If a participant in this market has the stomach and the financial backing, this market can be profitable.